Starting (if you’ll excuse the pun) with bad weather in the Spring of 1315, universal crop failures struck Europe creating what became know as The Great Famine. It lasted through 1316 and well into 1317 from Russia and Great Britain all the way down to Southern Italy.

Angels Bootcamp has just announced that it is to train over 1,000 new angel investors by 2015 starting this June in Berlin. We should all cheer the announcement of Angels Bootcamp, which aims to do what it says on the tin:

“AngelsBootcamp is targeted at executives, entrepreneurs and finance professionals who have money in the bank to put into tech startups but who lack the knowledge about exactly what an angel investor should do.” (as TNW reports)

But Berlin, we have a problem.

While I heartily support anything which will accelerate Europe’s entrepreneurs (especially if it helps consolidate London’s position as Europe’s leading tech startup hub) where is the money going to come from so that all these newly invested startups can continue after their first $250,000 or $500,000 of investment?

It’s a metaphorical stretch, but there’s no point encouraging people to start a large family, if they won’t be able to feed themselves!

Europe and even London, Europe’s foremost tech cluster, already has a funding gap for adolescent startups. In actual fact, so does New York’s tech cluster.

“New York and London have more than 70 percent less risk capital available than Silicon Valley for Startups in the early, Pre-Product pre-Market Fit” Stages of the Startup Lifecycle.” Startup Genome Report

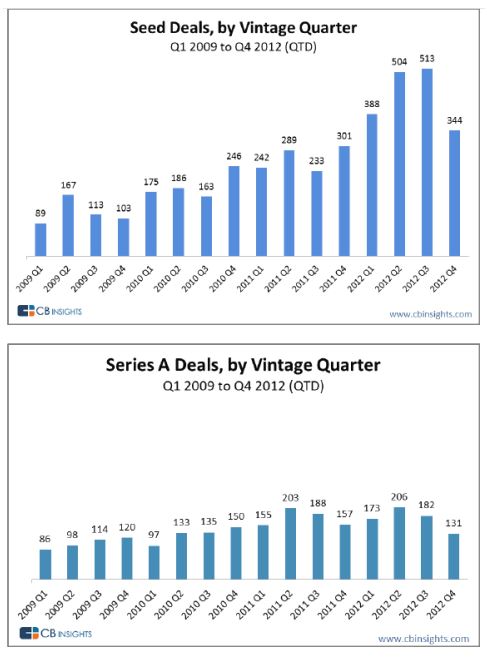

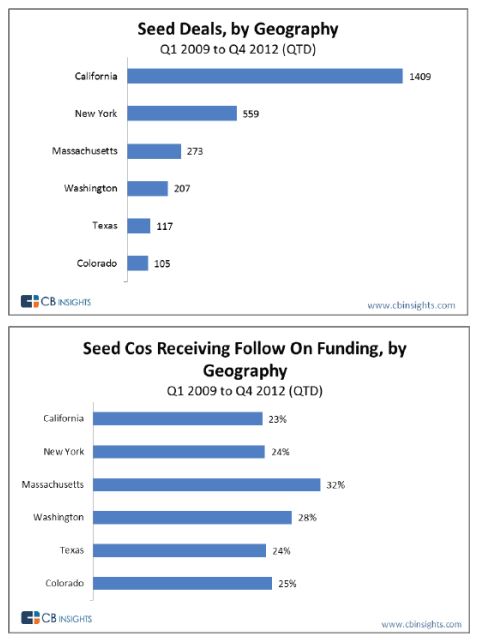

And moreover even at the end of the rainbow, in the home of funding-food and plenty Silicon Valley, startups are experiencing an issue with follow on funding. Check out the graphs below, tracking the number of seed deals versus Series-A for U.S. startups: (courtesy Techcrunch, read the full article here)

“The “crunch” is perceived because of the boom in seed funding, which has brought a greater quantity of startups to the table looking for Series A funding…” (from the article Mining The Crunch)

Europe must find a way not to end up with a worse funding famine that of Silicon Valley now, which is that hundreds of startups funded by Xoogler’s and X-Facebooker’s are going bust -or becoming startup zombies– because they are either not worthy of further funding or because the market cannot sustain so many startups.

At a macro level, many of the much larger funds – the grandfathers of the tech VC in the U.S. and Europe – don’t perceive a problem. Possibly because they invest later stage and have extremely large funds (so are somewhat detached from the mass of earlier stage startups) or perhaps because those famous names get the very top pick of deals.

I was lucky enough to get Felda Hardymon from BVP on my panel at the recent Innotech Summit, along with Steve Schlenker from DN, plus others from Silicon Valley and L.A. to discuss this very topic (we even managed to co-opt Boris Johnson, the Mayor of London).

Perhaps not surprisingly (given that Felda has been at BVP since 1981 a full 16 years before I did my first startup) I agreed with almost every word Felda said. All of which was extremely insightful except that there isn’t a funding gap for startups in Europe.

There’s not a lack of capital for sure, but capital which people are prepared to risk at that critical, very high risk, very early stage of the startup life cycle? For sure there’s a dearth.

Perhaps the Series-A problem is that the whole approach to funding at that stage of a startups lifecycle needs to change, as one or two people I spoke to afterwards suggested.

After all, seed funding and angel funding has evolved immensely even in the last 5 years. But until that mid-stage funding environment does change, or until we teach our startups how to make a whole lot of revenue very very early on, it means that we need to educate our new European Angels not to make un-fundworthy investment decisions(!).

At the same time as a community we must find ways to open up the $1m to $4m investment bracket to more startups, by lobbying those with capital and the government for favourable incentives, alongside championing the value of technology startups both to society as a whole and as a vehicle for investment.

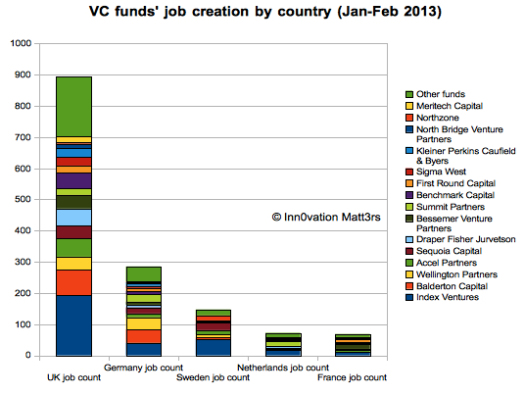

Venture investment (realistically, Series-A and above) create jobs. Fact. As crusades go, that’s a good a reason as any. (Read Nic Brisbournes full post on his excellent blog, which is where I stole this graph from)

In summary, Angel Bootcamp will go head and I wish it every success, but something needs to happen in the Series A world too, and there is much less chatter about solutions for this, or even talk of the problem, unless of course you’re a Founder trying to raise a Series-A round in Europe, and then you talk of nothing else..!

Europe did not fully recover until 1322 from the Great Famine of 1315, and while medieval starvation on a grotesque scale is more a human tragedy than any future mass deadpooling of startups, however severe, we should ask what can be done to ensure the tens of thousands of potential European jobs and startup Founder’s dreams, are not wasted away for lack of follow-on funding or Series A.

While supply and demand and market forces are one answer, I’m not sure a pure Friedman-esque approach to this growing problem is the only solution we should rely on.