As one technology Founder of many in the UK, a vote to leave the EU was not what we wanted, yet as entrepreneurs our task now is to find opportunity from the situation. If you’re a British national, indeed it is your responsibility.

After a painful post-War slide into depression (both economic and psychological) we have spent most of our own lifetime dragging the country’s economy, from public transport to bad 1980’s restaurant food, back to prosperity. Along with that has come a new sense of pride in what we can achieve and a glimpse of the confidence our forebears had – the leaders of the world’s Industrial Revolution.

The Victorian era championed Great Britain – and British values – while taking an outward looking, global and free-trade approach, albeit one akin to the times of Empire and gunboat diplomacy.

Our obligation now as their modern contemporaries, the leaders of a digital revolution, is to embrace this new challenge. Great Britain must not spin its wheels and risk sliding back in to the woe is us national unconsciousness of before, licking our self-inflicted wounds. We must waste no time in getting on with the job and uniting behind making the best of a bad job, something the British are renowned at doing!

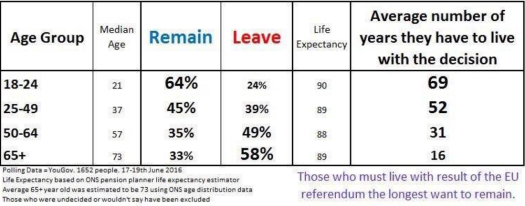

With one of the world’s largest GDPs, we must fight hard to maintain our own confidence, find the positive in a result that none of us asked for. If we don’t we risk leaving our immediate future in the hands of the small-minded few, the baton-up-the-hatches brigade. The older demographic who have voted for this situation, too young to remember the glory of Empire but all too familiar with a bankrupt post-Empire nation and repeated humiliation at the French blocking our entry to the EEC in 1963 and 1967 (a rather ungrateful act for a President we put in power!), they don’t understand the realities of a globally interconnected world in an age of information ubiquity.

The Remain campaign failed miserably to acknowledge the failings of today’s EU, nor articulate a positive vision for the future. The Brexit campaign focused on the red herring of immigration, taking advantage of the failure of successive UK governments to lead a proper debate or make a proper case, leaving many paranoid and fearful.

We must all now focus our efforts on promoting this opportunity, to drown out the talk of local X with a positive dialogue of how to improve our international position. That means:

- Finally tackling immigration head on. We must not allow the xenophobes to dictate policy but coming up with a better process to enable those who can help build our economy in, including progressive Entrepreneur’s VISAs; to know who is coming in and who is not (something an island should find easy!) to give naysayers confidence we have control of our own borders; of embracing true political and war torn refugees.

- Be confident even though we don’t feel it. As business owners we know that smoke and mirrors play a part in selling a product or raising investment. Presenting an optimistic but realistic narrative about how we’re changing the future and why someone should invest in our startups. This country is no different. We must continue to attract investment, we must talk a better game than we did in the debate and win the confidence of the international economy.

- Think Big. The risk you take in business should be proportional to the reward. We must articulate a vision for Great Britain which is not just positive but worthy of attention. As a startup investor I’m not interested in investing time, emotionally energy and money in companies who are not attempting to transform a market, to dominate their space. We must do the same for this country, and elect leadership who can articulate a goal based upon which decisions can be made, trade deals negotiated and policy crafted. A vision is needed behind which the country can unite.

In short, as a smaller nation than the EU as a whole, and without the shackles of having to compromise to the lowest common denominator, learning to move more quickly on policy and procedure is a prerequisite for our success. Estonia is a country of 1.5m which, with it’s digital mobile voting, digital e-citizenship and disproportionate entrepreneurial impact on the European tech ecosystem, has prove that smaller can indeed mean faster, learner and more successful. Maybe the UK should vote in a Prime Minister who can code, like Toomas Hendrik Ilves?

Anything is possible; no one knows what a renegotiation or a recreation of Great Britain’s relationship with Europe will look like.

One thing is for sure though, as the Liberal majority we’ve failed to quell the misguided rhetoric of the Brexit charlatans. We must not now let them dictate policy going forward and instead we have to dominate the conversation and make it one of opportunity, a chance to do things better, and of open borders to the World.

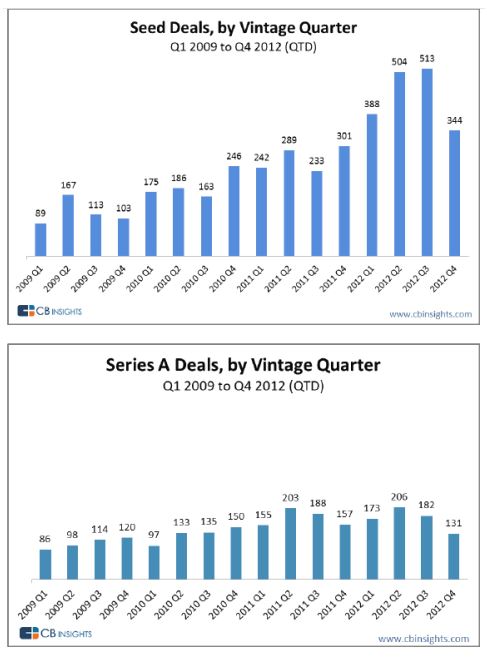

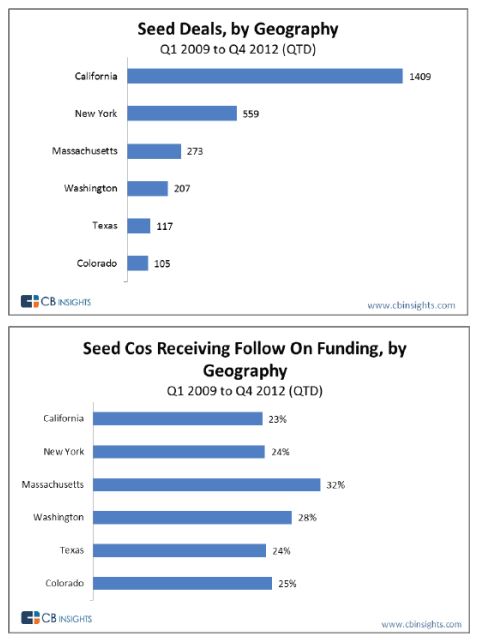

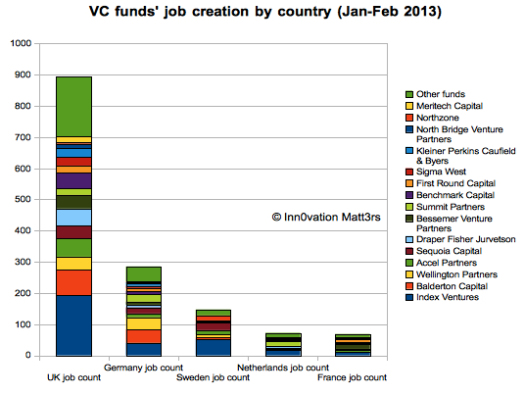

In reply to a post that someone replied to on Robert Scobles blog, saying that there was no issue with VC tech funding in Europe and that there was plenty money for startups and suggesting that it was just as easy to fund a company to build a multi-billion dollar business in Europe as the U.S. (the persons comments in italics), I recently wrote this response…

In reply to a post that someone replied to on Robert Scobles blog, saying that there was no issue with VC tech funding in Europe and that there was plenty money for startups and suggesting that it was just as easy to fund a company to build a multi-billion dollar business in Europe as the U.S. (the persons comments in italics), I recently wrote this response…